The latest online populist movement, given prominence through ad nauseum Fox News coverage, is the TEA Party organization. Tomorrow, wednesday April 15th, the organization will be holding nationwide protests and rallies in opposition to paying taxes. The coast-to-coast teabagging rallies will protest such things as: "spending trillions of borrowed dollars, leaving a debt our great-grandchildren will be paying"; people who "want to take your wealth and redistribute it to others"; "punish those who practice responsible financial behavior and reward those who do not"; "run up trillions of dollars of debt and then sell that debt to countries such as China... [and] want government controlled health care?"; "refuse to stop the flow of millions of illegal immigrants into our country"; and to protest "want to force doctors and other medical workers to perform abortions against their will... [and] want to impose a carbon tax on your electricity, gas and home heating fuels." At the Atlanta tax day TEA party, Sean Hannity will host his Fox News show; the entire event is also supported by Michelle Malkin and Newt Gingrich. Sounds fun!

Can I just point out that many of these items have nothing to do with taxes? Abortion? Immigration? Health Care policy? It's all a bunch of rubbish, if you ask me. And if you ask Paul Krugman, who had this to say: "The tea parties don't represent a spontaneous outpouring of public sentiment. They're AstroTurf (fake grass roots) events, manufactured by the usual suspects."

The conservatives who have organized these rallies and protests have wrapped themselves in the lore of our nation's early patriots, who dressed as Natives, and, in the dead of night, secreted upon boats carrying crates of tea. In protest of Britain's imposition of a tea tax, these patriots tossed the crates overboard, thus ruining the tea. The TEA protesters are not trying fighting for Independence, or fighting to throw off the yoke of oppression: this is the latest attempt by the right to undermine America-- to undermine progress. They scream "socialism," or decry Obama's deficit spending, or his so-called attempt to shift wealth from one class to another. Where were these voices when President Bush rammed his tax cuts for the uber wealthy through congress, which was literally the largest transfer of wealth in American history? Where were these voices when President Bush doubled the national debt, adding some $5 trillion? And he oversaw the Chinese take-over of the American economy! And where were these voices when President Bush started bailing out the giant financial institutions, who were free to run-amuck under his administration's deregulation policies? Where were these voices?

I'll tell you where these voices were--

These voices, only a few short years-- months-- ago were singing the praise of George W. Bush, and screaming at liberals or anyone who questioned the President, calling them "unpatriotic" or "un-American." These hypocrites have the audacity, after eight years of that shit, to call President Obama a tyrant, a socialist, or anything else they can think of, in a time when he is trying to fix all of the messes left behind by his predecessor. He didn't create the financial mess-- Bush did; he didn't allow the Chinese to buy up our debt-- Bush did; he didn't create the vast disparity between rich and poor-- Bush did; and on and on it goes. Now, President Obama find himself in the worst economic situation since the Great Depression, and these hypocritical Bush-lovers are ready to lynch the President. Just listen to the insanity of Rush Limbaugh, or Sean Hannity, or Glenn Beck... it's fucking madness! I- there are no words to describe how this just blows my fucking mind!

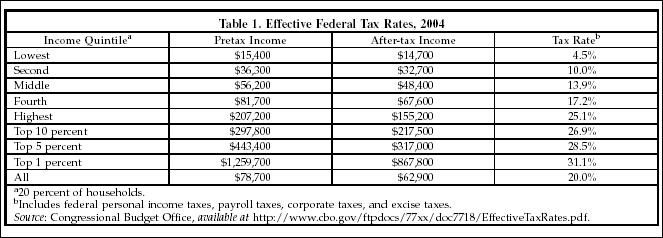

Even more amazing to me is the fact that there are so many Americans who are swayed by this ant-tax group. Yeah, it's a pain in the rear to have to pay taxes, but it is nonetheless necessary in order to have a civilized society-- it's nice to have roads, bridges, policemen and firemen, an education system, government, and all the fancy things we enjoy everyday, but take for granted. So it kills me when people, who are either lower class or lower-middle class, are so angry about the tax code. I totally understand why the mega-rich don't like paying taxes-- they pay quite bit in taxes every year. But, in reality, many of these mega-rich people find loop-holes or write-offs. In many cases, they either don't pay as much in taxes, or don't pay any taxes at all. Take, for instance, Warren Buffet, who is the worlds third richest man: Warren Buffet pays less in taxes than his secretary! At a fundraiser, Buffet admonished his fellow wealthy elites by saying, "The 400 of us [here] pay a lower part of our income in taxes than our receptionists do, or our cleaning ladies, for that matter. If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to think about the other 99 per cent.” He went on to describe how he had only paid 17.7% in taxes on the $46 million he made, while his secretary paid 30% on her $60,000 income. He described the Republican mentality that says, "I’m making $80 million a year – God must have intended me to have a lower tax rate.” This is the unequal tax system that the protesters are trying to maintain-- one that actually benefits the rich at their expense. They are angry that President Obama wants to create a fairer tax system by eliminating the Bush tax cuts on the super rich.

Where's the logic in that?

The debate on "fairness," with respect to taxation, has to do with equality. The rich complain about the fact that they pay more, which, they claim, is not fair. So, they send out the ignorant low and lower-middle class conservatives to protest a system that is, in reality, quite fair. The progressive tax system, created during President Roosevelt's administration, was intended to tax people according to their ability to bear burdens relative to their level of income. In other words, the poor should have a smaller burden than the rich, due to the disparity of their incomes. Seems fair to me. Then again, I'm a poor bloke, and not some fancy pants wealthy elitist like Rush Limbaugh.

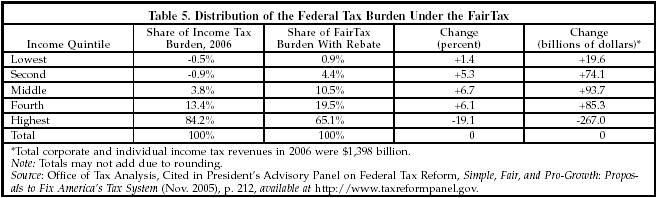

The growing trend among the conservative crowd is the so-called "Fair Tax" or the flat-tax. Mike Huckabee, during his 2008 Presidential campaign, boasted that "when the Fair Tax becomes law, it will be like waving a magic wand releasing us from pain and unfairness." This seems, on its face, to be a good deal: abolish the income tax and the Federal Reserve and embrace a 23% tax on all goods and services. Seems simple, right? It even sounds a bit fair. Ah, but when one actually looks into the plan, it really benefits those who are wealthy, and it is at the expense of the poor. This is essentially "supply-side" economics at its best.

See, we poor (my wife and I fall below the line of poverty) actually spend more than we make. We don't really save, not because we don't want to, but because there just isn't any money at the end of the month to do so. So, under the flat tax system, we would be paying at a 100% tax rate on our income. Those in the middle-class, who spend about 80% of their income, fall into the 80% tax bracket. Meanwhile, Warren Buffet and Bill Gates, who have loads of money that they could never spend in a lifetime, fall into the 5% tax bracket. So what this so-called Fair Tax does is penalize the poor and working class families, who already have a tough time making ends meet, while allowing the rich, who have money to burn, to spend less in taxes. Does this seem fair? Not only that, but the

Congressional Joint Committee on Taxation projected a ten year $2.5 trillion revenue shortfall in the event that the Fair Tax proposal became law. Hmmm... who would get to keep all that money? The rich, of course. Does that seem fair?

(Tables come from Bruce Bartlett)

To the Hannitys and Limbaughs of the world, it does.

Neal Boortz and John Linder, authors of the Fair Tax Book, argue that this obviously regressive tax system that favors the rich would still benefit the poor because of the "pre-bates" they would receive. Pre-bates, just to inform the reader, are determined by the Census Bureau's calculation for the poverty level, divided into twelve months, which would work out to $196. This income would go to everyone, at all levels of income despite need. Ah! But wait! Families who spend those pre-bates will be taxed again at the 23% rate.

There is also the issue of simplicity. The Fair Tax proponents argue that their proposed system would be easier. When Steve Forbes ran for president he famously pledged that Americans would only have to deal with a postcard sized tax return. Instead of Federal taxes, or state taxes, medicare or social security taxes, or corporate/business taxes, there would simply be one flat (and "fair") tax: the 23% tax on goods and services. Would people prefer to pay more in taxes and have a simpler system? Or, do you think, people would prefer a complicated system that allows them to pay less in taxes? I think the latter option is the obvious choice.

There are a whole host of other problems affiliated with the Fair Tax initiative. Critics fear an increase in black market sales; others wonder how the proposal will deal with tax evasion, since there will be no IRS; how will states get their revenue?; there is the matter of the revenue shortfall; how the proposal will affect workers' wages; and the cost of transitioning from one system to another.

Well, it's late and my wife is beckoning me to the mattress we have in the corner of our small bedroom. So, to end my diatribe, I can only wish the TEA baggers well. I hope it all goes down smoothly, and without fuss. I'd like to go, but I'm just not into that sort of thing. I was tempted to attend the rally in my town, bring along a video camera, and film the event. But I think I would go insane and start yelling at people... I would then be assaulted by an angry mob.

Thanks, but no thanks.

I'm celebrating Tax Day by working. Earning what little money I can, and paying what little taxes I can afford to Uncle Sam.

No comments:

Post a Comment